What is BlueInvest Investment Readiness Assistance?

BlueInvest Readiness Assistance is an exclusive and fully funded coaching programme for high potential EU start-ups and SMEs with innovative and sustainable products and solutions for the Blue Economy.

Businesses and projects selected will receive 64 hours of 1:1 expert coaching tailored specifically to their readiness levels and business objectives. The programme is impact-driven, with a clear focus on providing business support to help startups and SMEs grow and attract investment.

Applications are closed.

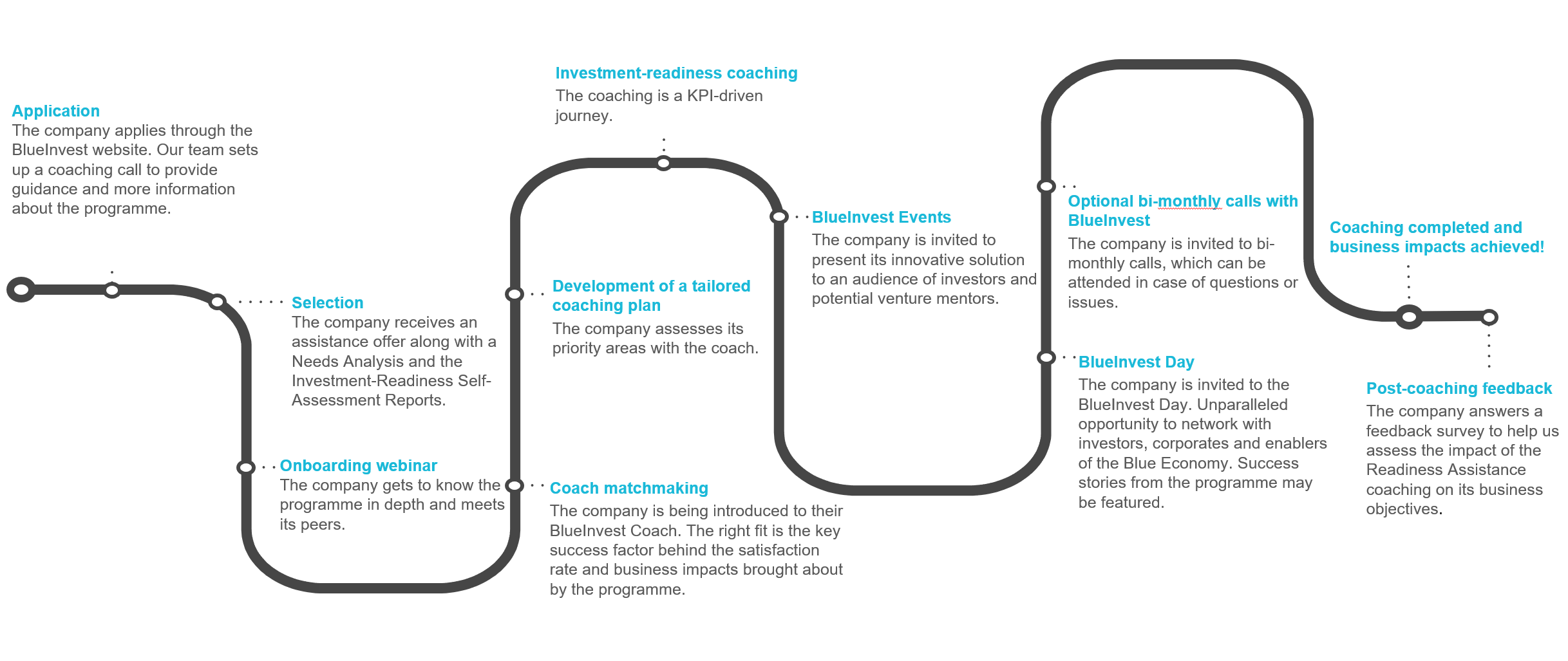

Investment Readiness Assistance User Journey

For any questions, reach out to us at lu-blueinvest@pwc.lu.

(4).png)

(4).png)

(1).png)

(1).png)

.png)

.png)

.png)

.png)

.png)

.png)